|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cheap Breakdown Insurance: A Comprehensive Coverage GuideExploring vehicle protection options can be overwhelming for U.S. consumers, especially when it comes to breakdown insurance. However, understanding cheap breakdown insurance can offer peace of mind and significant cost savings. In this guide, we'll delve into the benefits and specifics of this type of coverage. Understanding Cheap Breakdown InsuranceBreakdown insurance is designed to cover the costs associated with vehicle repairs and towing services. It's a form of protection that ensures you aren't left stranded on the side of the road with a hefty repair bill. Key Benefits

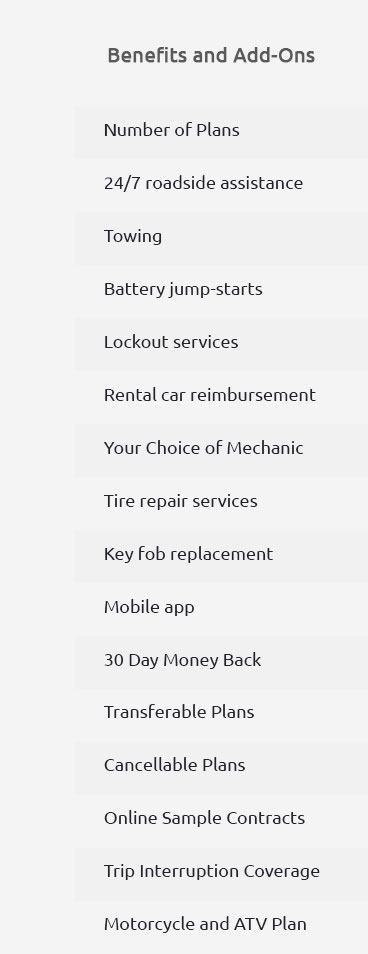

What's Covered?Cheap breakdown insurance typically includes a variety of services that can help you in a pinch. Here's what you can generally expect:

For more detailed coverage options, consider checking an online extended auto warranty quote to see what fits your needs best. How to Choose the Right PolicyAssess Your NeedsConsider how often you drive and the age of your vehicle. Older vehicles might benefit more from comprehensive coverage. Compare PlansNot all policies are created equal. Look for plans that offer the most relevant benefits for your lifestyle. Read ReviewsResearch customer feedback to gauge the reliability of potential insurers. Use resources like the advance auto warranty lookup to better understand the coverage of existing warranties. FAQsWhat is cheap breakdown insurance?Cheap breakdown insurance is an affordable policy that covers various vehicle repair costs and roadside assistance services. How can breakdown insurance save me money?By covering the cost of towing, repairs, and emergency services, breakdown insurance can significantly reduce out-of-pocket expenses for vehicle breakdowns. Is breakdown insurance worth it for older vehicles?Yes, older vehicles are more prone to breakdowns, making breakdown insurance a worthwhile investment for coverage and peace of mind. https://www.motoringassist.com/breakdown-cover

With all that included, GEM not only provides exceptional coverage but also offers it at a competitive price...we're still cheaper than similar personal ... https://www.rescuemycar.com/

Take a look at our services and see how we compare ; National & Home, 180, 191.51, 46.99, 15.89 ; National, 130, 137.50, 46.09, 18.09. https://www.thezebra.com/homeowners-insurance/coverage/equipment-breakdown-coverage/

Equipment breakdown coverage is usually very affordable. Many insurance companies offer this coverage somewhere in the neighborhood of $20 to $50 per year.

|